AI-Powered Claims Automation Speeds Up Settlements and Reduces Costs

Insurance claims are an important moment of truth between insurers and their customers, but the need for manual review keeps processes slow and costly. Policyholders might wait weeks for resolutions, meanwhile insurers face mounting paperwork backlogs and rising costs, with delays eroding trust and increasing fraud risk.

Customer expectations of the industry have also changed. Policyholders now expect fast, transparent, fair outcomes that match the digital standards set by Europe’s leading banks, retailers, utilities, service and mobility providers. Meeting these demands while controlling expenses is one of the industry’s biggest challenges.

AI-powered claims automation flips the script on the old way of doing things. Natural language processing (NLP), image recognition, predictive analytics and intelligent workflows now help insurers validate and process claims in near real time. These technologies work in tandem to reduce manual effort and lower costs, while delivering faster, fairer resolutions that strengthen satisfaction and trust.

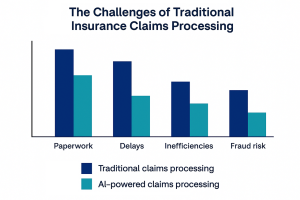

The Challenges of Traditional Insurance Claims Processing

Many insurers still rely on manual reviews with physical documentation, and internally companies are riddled with fragmented communications. Front-end portals have digitized claim intake, but the back-end processes that determine assessment and settlement still lag behind, leading to prolonged cycle times. Without streamlined workflows, claims stall across review handoffs and paperwork queues, creating backlogs that escalate rapidly.

Fraud intensifies the pressure. In Europe, fraud (both detected and undetected) is estimated to account for around 10% of total claims expenditure. Many non-life claims are believed to carry some fraudulent component; industry consensus suggests 10-15% across such lines, while best-practice insurers in Europe target fraud reductions of ≥3% of claims outlay.

These inefficiencies and risks combine to prolong claim cycles and erode profitability via higher claim processing costs. And when policyholders wait weeks for resolutions, it strains relationships and drives customer dissatisfaction.

Traditional methods simply can’t deliver the speed and accuracy required by modern insurance operations.

What Is AI-Powered Claims Automation?

AI-powered claims automation uses artificial intelligence and machine learning to handle tasks that before were entirely manual. Instead of adjusters reviewing every record by hand, algorithms process unstructured data and evaluate claims against policy rules automatically while flagging potential fraud for manual review. You now have an end-to-end process that moves from first notice of loss (FNOL) to settlement with vastly improved speed and consistency.

Natural Language Processing (NLP) in Insurance

Most of the data in claims files are unstructured, like emails, call transcripts, handwritten notes or scanned documents. NLP in insurance extracts meaning from that information, classifying details such as damages and liability indicators. Tasks that used to consume hours are completed in seconds, improving accuracy and consistency.

Image Recognition for Claims Assessment

Image recognition for claims turns photos and video into structured evidence. AI models in auto lines assess vehicle damage from uploaded images; in property claims, drone or satellite imagery supports damage evaluation after disasters. These capabilities speed up assessment and reduce the need for site visits.

Predictive Analytics and Scoring for Fraud Detection

AI indisputably strengthens fraud detection in insurance. Predictive analytics in insurance assigns risk scores to each claim, comparing patterns against historical data to highlight anomalies. Straightforward claims are processed quickly, while questionable submissions are escalated for human review.

Intelligent Workflows from FNOL to Settlement

Intelligent workflows bring these technologies together to automatically route claims, trigger document requests and validate information in near real time. This creates fewer manual handoffs and provides scalable processes that deliver faster, fairer outcomes.

How Intelligent Workflows Deliver Results

Deploying AI creates intelligent workflows that deliver measurable improvements across the claims lifecycle. Claims that once took weeks can now be validated in hours or even minutes through near real-time claims validation. Automated checks confirm policy coverage and review evidence, then route approvals with minimal delay to ease backlogs and improve experiences. For example, one Nordic insurer working with EY cut manual effort and claim turnaround time by automating unstructured data processing across multiple lines of business.

Manual handling unavoidably introduces errors and inconsistent outcomes. NLP in insurance and computer vision apply rules consistently, reducing variability and overlooked details. Staff are relieved of repetitive reviews and can focus on complex, high-value cases. And with fewer manual touchpoints, insurers achieve measurable savings. Automation can reduce claims handling costs by up to 30%, delivering clear automation ROI through faster resolutions and reduced fraud exposure with minimal labor needs.

Providers such as Cognizant and Shift Technology report similar improvements using NLP and deep-learning models to detect errors and automate reviews across health and property claims. In the UK, insurers adopting end-to-end automation through partners such as Tractable report cost reductions of up to 25% and faster settlements for auto claims.

Resolving claims quickly and fairly enhances customer satisfaction in insurance, improving retention and overall trust scores. Transparent workflows that provide real-time updates build trust and turn the claims process into a competitive differentiator. Customer retention improves almost automatically with fewer resources expended to achieve it.

Real-World Applications of Claims Automation

The value of AI-powered claims automation is best seen in real-world scenarios across different insurance lines:

Auto Insurance: Damage Detection with AI Vision

When a driver files a claim after an accident, they can upload photos of the damage directly through a mobile app. AI models use image recognition for claims to assess the severity of dents, scratches, or broken parts, estimate repair costs and match them against policy coverage. What previously took days of adjuster visits and manual estimates can now be processed in near real time, enabling faster settlements and reducing repair shop disputes.

One example of this innovation is DriveX, an Estonian insurtech offering AI-based vehicle inspections for CASCO and windshield claims. Their guided photo capture and instant analysis let insurers process routine damage claims in minutes instead of days.

Health Insurance: Automated Medical Claim Adjudication

NLP in the health and accident insurance sector transforms medical reports, invoices and diagnostic codes into structured data. Combined with predictive analytics, this helps insurers check claims against policy terms and detect inconsistencies, speeding up routine reimbursements while flagging questionable submissions for review.

Property Insurance: Drones and Satellite Imagery for Assessments

Sending adjusters to every damaged property after a natural disaster is costly and time consuming. Instead, insurers can deploy drones or use satellite imagery to gather real time visual evidence. AI-powered systems analyze the data to assess roof damage, flooding, fire, storm or hail impact, the types of losses that drive most claims volumes in Europe. Insights are then integrated into intelligent workflows to accelerate mass claims processing while minimizing safety risks for staff.

Overcoming Adoption Challenges

Despite the benefits, implementing insurance claims automation with AI requires addressing technical and regulatory barriers, but also the human factor when working with staff and customers around how processes will be automated.

Many insurers still run legacy systems on decades-old platforms unsuited for advanced analytics. Successful projects depend on APIs, middleware or data integration re-platforming to create scalable software solutions that support automation.

Insurance in Europe is also tightly regulated under frameworks such as GDPR, Solvency II, EIOPA and other guidelines at the national, regional or local levels. Automated decisions must be auditable and demonstrably free from bias. Embedding software innovation for insurers within a governance framework for ethical AI provides compliance while maintaining customer trust.

Automation should augment adjusters, not replace them. To reduce resistance and improve adoption, insurers should train employees to use AI insights while retaining authority over complex cases. Strong technology leadership helps align teams around the long-term vision.

The Future of Claims Processing

AI is at the centre of the digital transformation in insurance, shifting claims from a reactive service to an immediate, data-driven experience. Advances in automation and integration mean that many claims can now be validated and paid out at record speed. For simple auto and property cases, near real-time claims validation is fast becoming the norm.

Wider adoption of connected vehicles, wearables, IoT and smart home sensors will feed more and more data over time directly into claims workflows. Those signals combine with AI and telematics to enable faster, more accurate assessments and even complete prevention of certain claims, creating a new model of proactive insurance service.

Complex or sensitive claims will continue to rely on human expertise. Adjusters working under a hybrid model are supported by AI-driven insights with NLP and image recognition along with predictive analytics that improve accuracy while maintaining accountability and empathy with customers.

AI-powered claims automation lowers costs, accelerates settlements, improves fraud detection and boosts customer satisfaction. Insurers that invest now will lead the industry, while those that delay risk falling behind as real-time claims handling becomes the standard.

According to McKinsey, AI will reshape claims operations across Europe, with early adopters realizing up to 50% faster cycle times and double-digit reductions in loss-adjustment expenses.

Turn Intelligent Workflows into Real Results

The future of claims is faster, fairer, more transparent and better trusted. Now is the time for decisive technology leadership to turn that future into a reality, and our team has the tools and experience to help insurers achieve it.

DO OK designs and delivers intelligent workflows that bring AI-powered claims automation to life. We help insurers implement scalable software solutions like NLP and image recognition or predictive scoring that speed up settlements, cutting costs and improving customer trust. Connect with us today and explore how your claims process can move from weeks to near real time with more efficiency and improved customer trust.